Social Security Withholding Percentage 2025

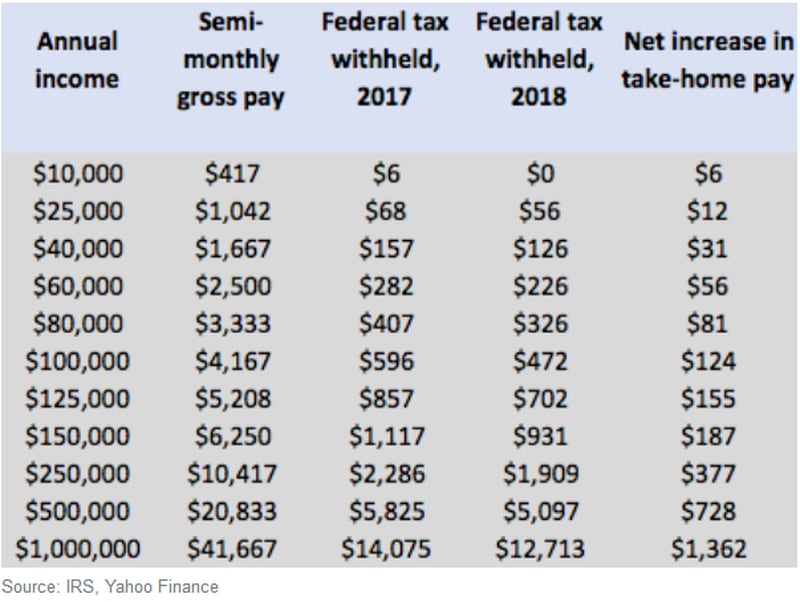

Social Security Withholding Percentage 2025 - Social Security Withholding Calculator 2025 Tax Withholding Estimator, More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi). You can have 7, 10, 12 or 22 percent of your monthly benefit. Paying Social Security Taxes on Earnings After Full Retirement Age, Social security cola is 3.2% for 2025 A retiree can use the tax withholding estimator to enter any pension income or social security benefits they or their spouse receive.

Social Security Withholding Calculator 2025 Tax Withholding Estimator, More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi). You can have 7, 10, 12 or 22 percent of your monthly benefit.

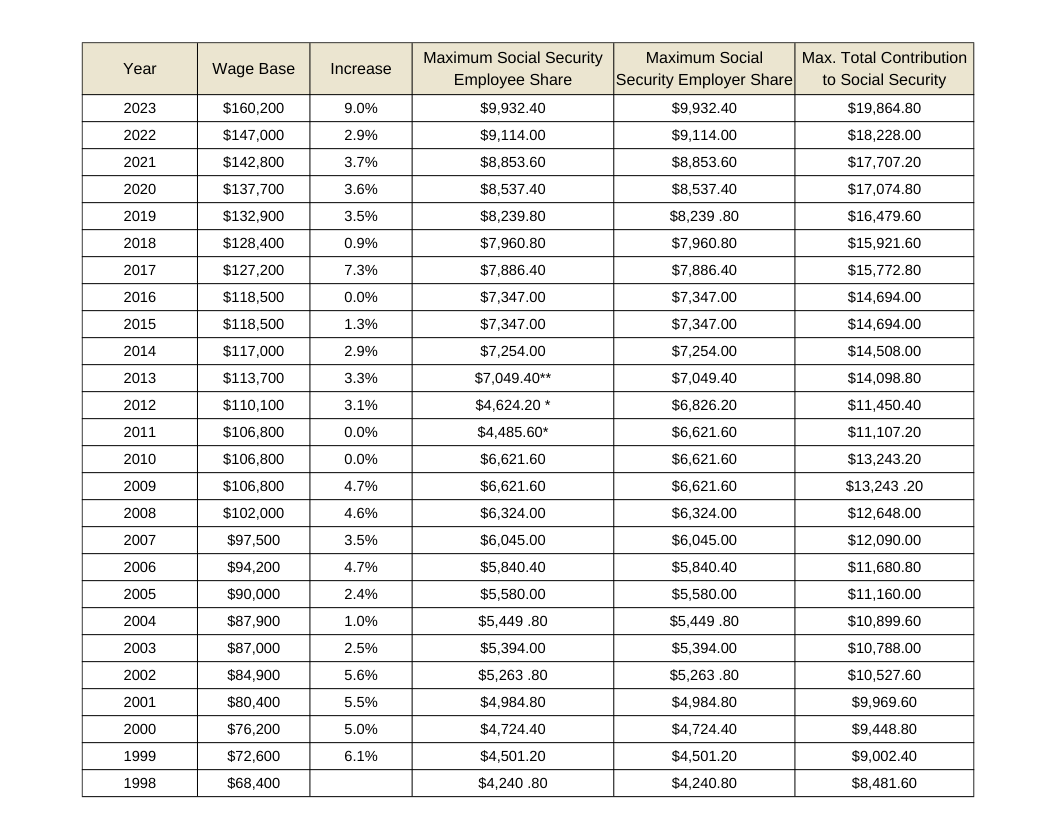

Federal Withholding Tables 2025 Federal Tax, The federal government sets a limit on how much of your income is subject to the social security tax. Enter the age at which you'd like to start taking your social security retirement benefits.

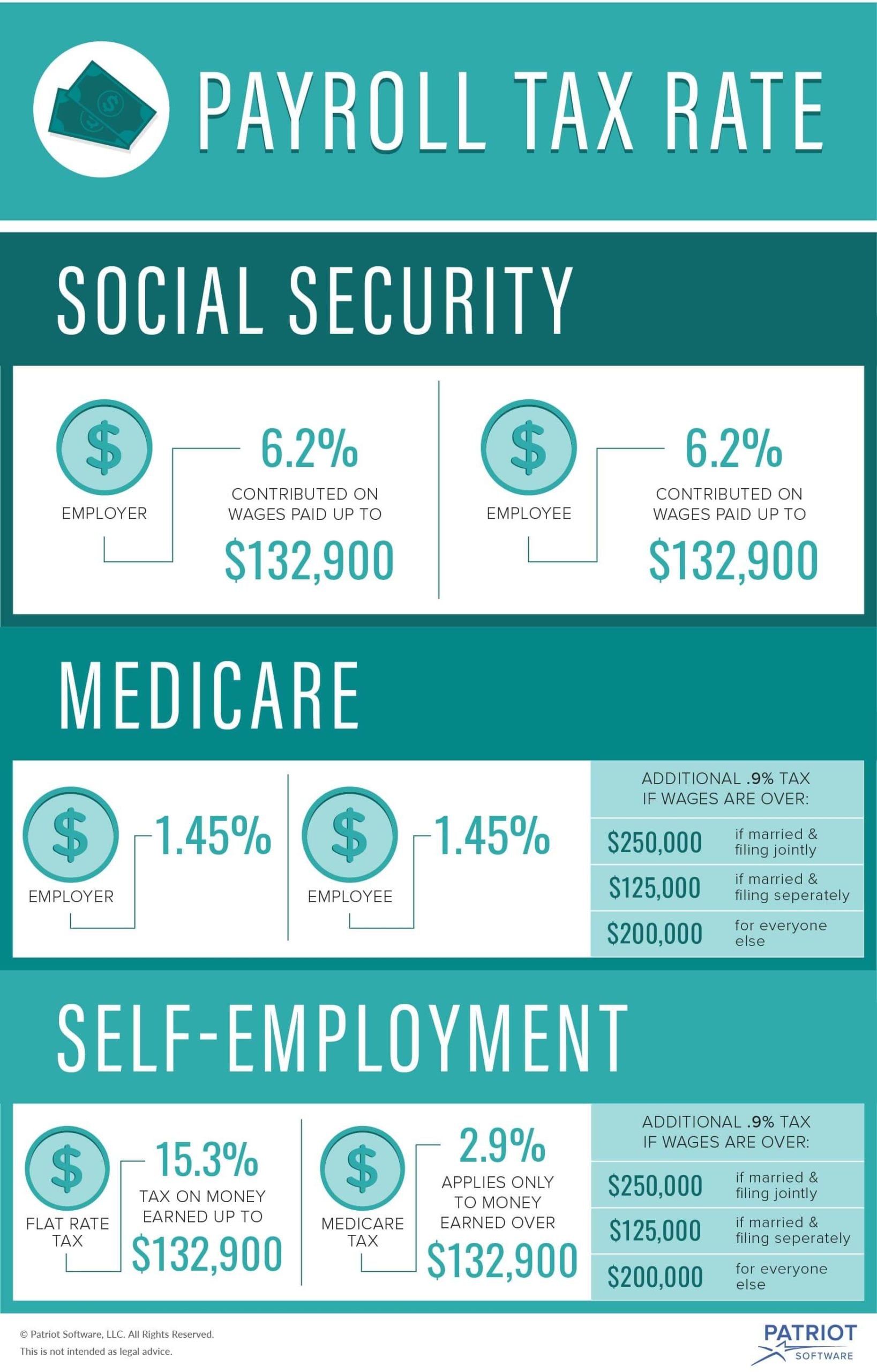

Here's why there's more money in your paycheck, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. If you start collecting social security before full retirement age, you can earn up to $1,860 per month ($22,320 per year) in 2025 before the ssa will start withholding.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

How To Calculate, Find Social Security Tax Withholding Social, The hi (medicare) is rate is set at 1.45% and. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi).

More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi).

Social Security Withholding Percentage 2025. (thus, the most an individual employee. / updated december 06, 2023.

More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi).

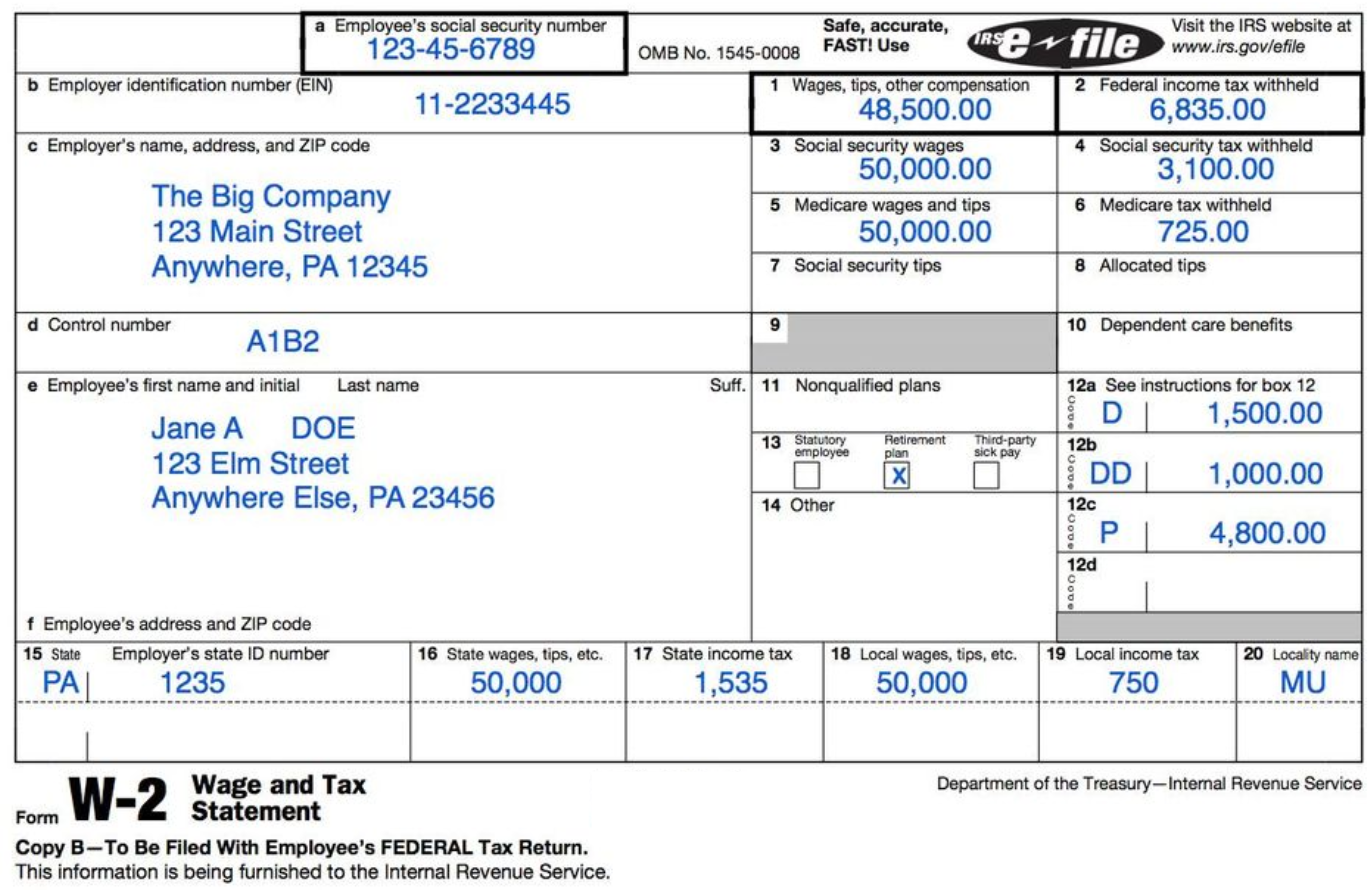

What Is The Social Security And Medicare Tax Rate, The law requires employers to withhold a certain percentage of an employee’s wages to help fund social security and medicare. The social security tax limit refers to the maximum amount of earnings that are subject to social security tax.

Limit For Maximum Social Security Tax 2025 Financial Samurai, Social security and supplemental security income (ssi) benefits will increase by 3.2% in 2025. The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2023 wage base of.

Social Security Wage Base 2025 [Updated for 2023] UZIO Inc, You can have 7, 10, 12 or 22 percent of your monthly benefit. Social security taxes in 2025 are 6.2 percent of gross wages up to $168,600.

Es Seguro Viajar A Nicaragua 2025. Nicaragua es un país relativamente seguro para viajar, aunque […]